One Person Company (OPC) Registration - Online Process

Register your One Person Company (OPC) online in India within 7–10 days with expert assistance from SP Legal Consultants. Simplified process, hassle-free documentation, and professional guidance for seamless OPC registration.

One Person Company (OPC) Registration - Online Process

Register your One Person Company (OPC) online in India within 7–10 days with expert assistance from SP Legal Consultants. Simplified process, hassle-free documentation, and professional guidance for seamless OPC registration.

The introduction of the Companies Act, 2013, brought the concept of One Person Company (OPC) to encourage small traders and entrepreneurs with the potential to establish their own businesses and create a distinct identity. One of the key advantages of an OPC is that it requires only a single individual to initiate the business. This allows an entrepreneur to have complete control over their venture. In contrast, a Private Limited Company or a Limited Liability Partnership (LLP) requires a minimum of two members for incorporation.

The concept of OPC was first proposed in the J.J. Report to empower entrepreneurs by providing them with a structured legal framework to bring their ideas to life. With advancements in information technology and the rapid growth of the service sector in India, the government introduced OPC as a progressive business model to support innovation and independent business ownership.

Before Registering Your Company Directly under Govt. of India

Once you are Ready to Setup your Dream Company, you’ll receive Rs 999 adjustment from your selected package from us.

Need Help with One Person Company Registration?

Fill Up the below Mentioned Form

The introduction of the Companies Act, 2013, brought the concept of One Person Company (OPC) to encourage small traders and entrepreneurs with the potential to establish their own businesses and create a distinct identity. One of the key advantages of an OPC is that it requires only a single individual to initiate the business. This allows an entrepreneur to have complete control over their venture. In contrast, a Private Limited Company or a Limited Liability Partnership (LLP) requires a minimum of two members for incorporation.

The concept of OPC was first proposed in the J.J. Report to empower entrepreneurs by providing them with a structured legal framework to bring their ideas to life. With advancements in information technology and the rapid growth of the service sector in India, the government introduced OPC as a progressive business model to support innovation and independent business ownership.

Before Registering Your Company Directly under Govt. of India

Once you are Ready to Setup your Dream Company, you’ll receive Rs 999 adjustment from your selected package from us.

Need Help with One Person Company Registration?

Fill Up the below Mentioned Form

Select Package

Consultation Fee

Expert advice from Highly Experienced CA/CS

Rs. 999

- Complete guide for registration (Process, Required Documents, Benefits, Tax and Legal Compliance, Timeframe etc.)

Basic

Rs. 3999

- Register your One Person Company at Ministry of Corporate Affairs

- Drafting & Filing by CA/CS, Expert advice by CA/CS

- MCA processing and CIN

- Spice+ Part A, Spice + Part B

- Company PAN & TAN

- MOA

- AOA

- Allotment of 1 DIN

- ESI and PF registration

- Current account opening in your nearest branch

- GST registration and Current account opening in your nearest branch

Smart

Rs. 16999

- Register your Private Limited Company at Ministry of Corporate Affairs

- Drafting & Filing by CA/CS

- Expert advice by CA/CS

- MCA processing and CIN

- Spice + Part A,

Spice + Part B

- Spice + Part A,

Spice + Part B Company PAN & TAN

- MOA

- AOA

- Allotment of 1 DIN

- ESI and PF registration

- GST registration

- Current Account Opening in your nearest branch

- The 1st Board Resolution documentation

- Consent Letter drafting, appointment of the Auditor

- INC-20A commencement of business

- Financial statements preparation

- MCA annual return filing

- MCA annual return filing and DIR-3 Director KYC

Mega

Rs. 27999

- Register your Private Limited Company with the Ministry of Corporate Affairs

- Drafting & Filing by CA/CS

- Expert advise by CA/CS

- MCA processing and CIN

- 1 Trademark Application

- Company PAN & TAN

- MOA

- AOA

- Allotment of 1 DIN

- ESI and PF registration

- Current Account Opening in your nearest branch

- GST registration

- The 1st Board Resolution documentation

- Consent Letter drafting

- Appointment of the Auditor

- INC-20A commencement of business

- Financial statements preparation

- MCA annual return filing

- MCA annual return filing, and income tax return filing and DIR-3 Director KYC

- GST Return filing for 12 months

Consultation Fee

Expert advice from Highly Experienced CA/CS

Rs. 999

- Complete guide for registration (Process, Required Documents, Benefits, Tax and Legal Compliance, Timeframe etc.)

Basic

Rs. 3999

- Register your One Person Company at Ministry of Corporate Affairs

- Drafting & Filing by CA/CS, Expert advice by CA/CS

- MCA processing and CIN

- Spice+ Part A, Spice + Part B

- Company PAN & TAN

- MOA

- AOA

- Allotment of 1 DIN

- ESI and PF registration

- Current account opening in your nearest branch

- GST registration and Current account opening in your nearest branch

Smart

Rs. 16999

- Register your Private Limited Company at Ministry of Corporate Affairs

- Drafting & Filing by CA/CS

- Expert advice by CA/CS

- MCA processing and CIN

- Spice + Part A,

Spice + Part B

- Spice + Part A,

Spice + Part B Company PAN & TAN

- MOA

- AOA

- Allotment of 1 DIN

- ESI and PF registration

- GST registration

- Current Account Opening in your nearest branch

- The 1st Board Resolution documentation

- Consent Letter drafting, appointment of the Auditor

- INC-20A commencement of business

- Financial statements preparation

- MCA annual return filing

- MCA annual return filing and DIR-3 Director KYC

Mega

Rs. 27999

- Register your Private Limited Company with the Ministry of Corporate Affairs

- Drafting & Filing by CA/CS

- Expert advise by CA/CS

- MCA processing and CIN

- 1 Trademark Application

- Company PAN & TAN

- MOA

- AOA

- Allotment of 1 DIN

- ESI and PF registration

- Current Account Opening in your nearest branch

- GST registration

- The 1st Board Resolution documentation

- Consent Letter drafting

- Appointment of the Auditor

- INC-20A commencement of business

- Financial statements preparation

- MCA annual return filing

- MCA annual return filing, and income tax return filing and DIR-3 Director KYC

- GST Return filing for 12 months

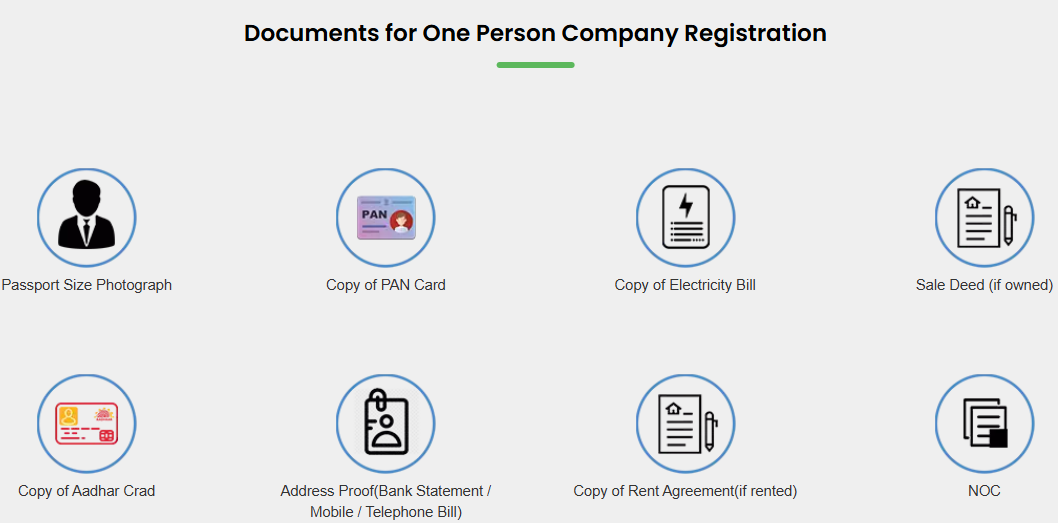

Documents for One Person Company Registration

How do we work?

1.

Fill our Registration Form & Make the Payment

2.

Expert Will Call You & Receive All the Necessary Documents.

3.

Will Create DSC & the DIN Number of Director

4.

MOA and AOA Drafting & Submit

5.

Your Documents will be Filed & Submitted to the ROC

6.

Congratulations! You've registered your company.Certificates will be sent by post.

1.

Fill our Registration Form & Make the Payment

2.

Expert Will Call You & Receive All the Necessary Documents.

3.

Will Create DSC & the DIN Number of Director

4.

MOA and AOA Drafting & Submit

5.

Your Documents will be Filed & Submitted to the ROC

6.

Congratulations! You've registered your company.Certificates will be sent by post.

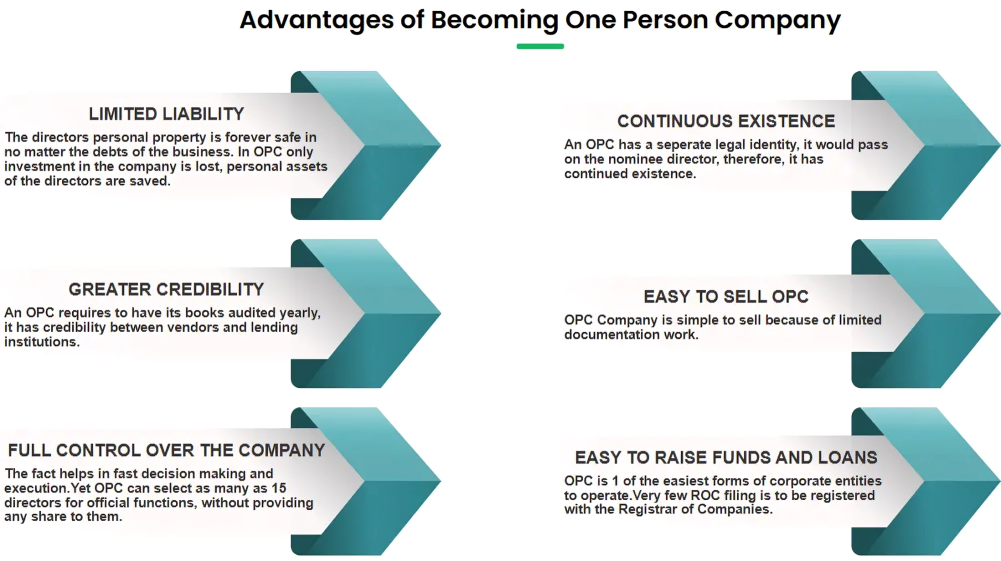

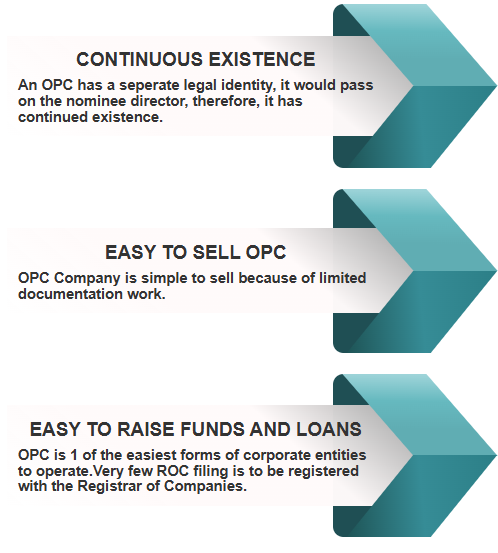

Advantages of Becoming One Person Company

Why Choose Us ?