Fast LLP Registration Services In India

Apply for LLP Registration Online at the lowest fees in India with SP Legal Consultants.

Experience a seamless process with minimal documentation.

Ensure legal compliance and secure your business structure with a Limited Liability Partnership.

Register now and take the first step toward business growth.

Fast LLP Registration Services In India

Apply for LLP Registration Online at the lowest fees in India with SP Legal Consultants.

Experience a seamless process with minimal documentation.

Ensure legal compliance and secure your business structure with a Limited Liability Partnership.

Register now and take the first step toward business growth.

With the enactment of the Companies Act, 2013, the concept of a One Person Company (OPC) was introduced to empower small traders and entrepreneurs with the potential to establish their own businesses and build a unique identity.

One of the biggest advantages of an OPC is that only a single individual is required to start the business.

This allows entrepreneurs to have complete control over their venture, unlike a Private Limited Company or an LLP, which require a minimum of two members for incorporation.

The idea of One Person Company was first proposed in the J.J. Report to encourage entrepreneurship by enabling individuals to transform their innovative ideas into successful businesses.

With the increasing adoption of information technology and the rapid expansion of the service sector in India, the government introduced the OPC model to support independent business owners.

Before Registering Your Company Directly under Govt. of India

Once you are Ready to Setup your Dream Company, you’ll receive Rs 999 adjustment from your selected package from us.

Need Help with LLP Partnership Registration ?

Fill Up the below Mentioned Form

With the enactment of the Companies Act, 2013, the concept of a One Person Company (OPC) was introduced to empower small traders and entrepreneurs with the potential to establish their own businesses and build a unique identity.

One of the biggest advantages of an OPC is that only a single individual is required to start the business.

This allows entrepreneurs to have complete control over their venture, unlike a Private Limited Company or an LLP, which require a minimum of two members for incorporation.

The idea of One Person Company was first proposed in the J.J. Report to encourage entrepreneurship by enabling individuals to transform their innovative ideas into successful businesses.

With the increasing adoption of information technology and the rapid expansion of the service sector in India, the government introduced the OPC model to support independent business owners.

Before Registering Your Company Directly under Govt. of India

*Once you are Ready to Setup your Dream Company, you’ll receive Rs 999 adjustment from your selected package from us.

Need Help with LLP Partnership Registration ?

Fill Up the below Mentioned Form

Select Package

Consultation Fee

Expert advice from Highly Experienced CA/CS

Rs. 999

Complete guide for registration (Process, Required Documents, Benefits, Tax and Legal Compliance, Timeframe etc.)

Basic

Rs. 5499

Register your Section 8 company at Ministry of Corporate Affairs.

Drafting & Filing by CA/CS

Expert advice by CA/CS

MCA processing and CIN

RD license

Company PAN & TAN

MOA

AOA

Allotment of 2 DIN

Estimated Income & Expenditure Account for the next 3years (mandatory for Sec-8 company registration)

Smart

Rs. 14999

Register your Section 8 company at Ministry of Corporate Affairs

Drafting & Filing by CA/CS

Expert advice by CA/CS

MCA processing and CIN

RD license

Company PAN & TAN

MOA

AOA

Allotment of 2 DIN

Estimated Income & Expenditure Account for the next 3years (mandatory for Sec-8 company registration)

Financial statements preparation

MCA annual return filing

MCA annual return filing and DIR-3 Director KYC

Auditor Appointment

Mega

Rs. 24999

Register your Section 8 company at Ministry of Corporate Affairs

Drafting & Filing by CA/CS

Expert advice by CA/CS

MCA processing and CIN

RD license

Company PAN & TAN

MOA

AOA

Allotment of 2 DIN

Trademark application

Estimated Income & Expenditure Account for the next 3years (mandatory for Sec-8 company registration)

Financial statements preparation

MCA annual return filing

MCA annual return filing and income tax return filing and DIR-3 Director KYC

Auditor Appointment

Consultation Fee

Expert advice from Highly Experienced CA/CS

Rs. 999

- Complete guide for registration (Process, Required Documents, Benefits, Tax and Legal Compliance, Timeframe etc.)

Basic

Rs. 5499

- Registering a LLP with Ministry of Corporate affairs

- LLPIN

- PAN

- TAN

- MCA processing

- FILIP

- Allotment of 2 DPIN

- Allotment of 2 DPIN and GST registration

Smart

Rs. 14999

- Registering a LLP with Ministry of Corporate affairs

- LLPIN

- PAN

- TAN

- MCA processing

- FILIP

- Allotment of 2 DPIN

- GST registration

- Income tax return filing

- Form 11 (Annual return of LLP)

- Form 8 (Statement of Accounts) and DIR-3 eKYC of - Directors

Mega

Rs. 24999

- Registering a LLP with Ministry of Corporate affairs

- LLPIN

- PAN

- TAN

- MCA processing

- FILIP

- Allotment of 2 DPIN

- GST registration

- Trademark application

- Income tax return filing

- Form 11 (Annual return of LLP)

- Form 8 (Statement of Accounts)

- DIR-3 eKYC of Directors

- 12 months filing of GST return and DIR-3 eKYC of Directors

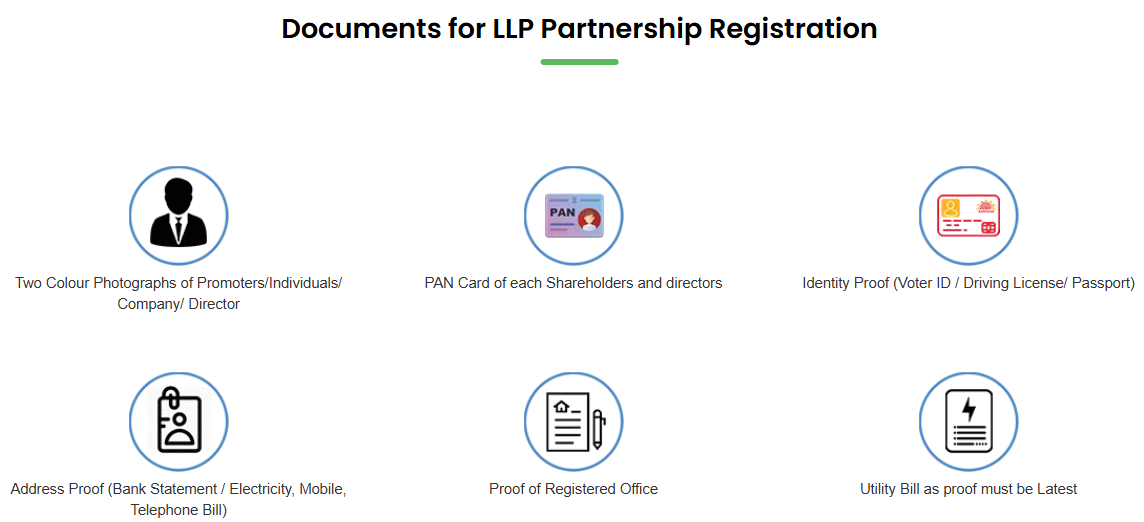

Documents for LLP Partnership Registration

How do we work?

1.

Fill our Registration Form & Make the Payment

2.

Expert Will Call You & Receive All the Necessary Documents.

3.

Will Create DSC & the DIN Number of Director

4.

LLP Deed Drafting & Submit

5.

Your Documents will be Filed & Submitted to the ROC

6.

Congratulations! You've registered your company.Certificates will be sent by post.

1.

Fill our Registration Form & Make the Payment

2.

Expert Will Call You & Receive All the Necessary Documents.

3.

Will Create DSC & the DIN Number of Director

4.

LLP Deed Drafting & Submit

5.

Your Documents will be Filed & Submitted to the ROC

6.

Congratulations! You've registered your company.Certificates will be sent by post.

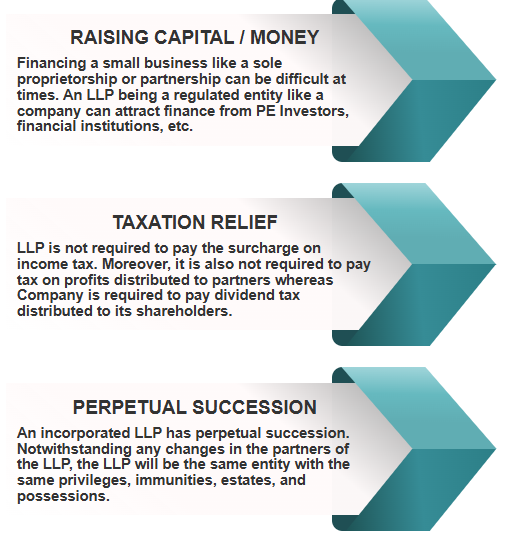

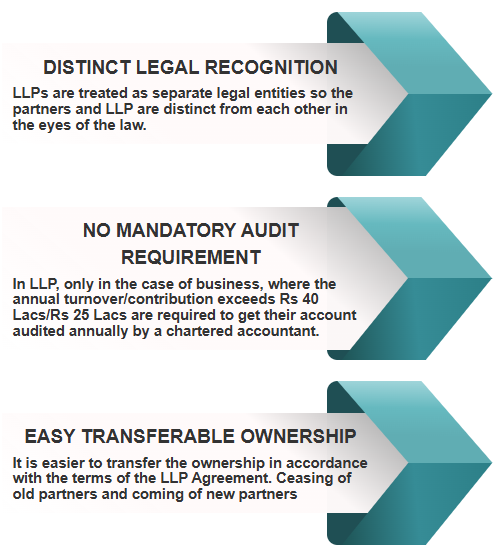

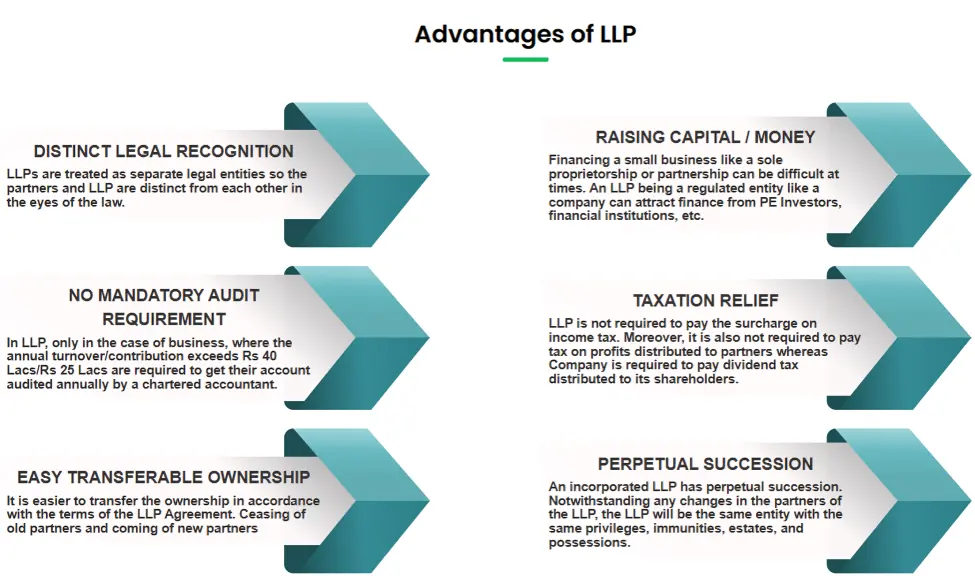

Advantages of LLP